December 2025

THE CIO’S PERSPECTIVE

In November, most markets around the world were hit by sudden doubts about the future returns on the massive capital expenditures of hyperscalers in the US. According to Jefferies calculations, a total of USD694bn were invested by hyperscalers since 2023 in data centres, benefiting largely Nvidia (and to a smaller extent AMD) and its ecosystem. Identifying a profitable business model behind the ever-growing number of large language models remains to this day an open question. These doubts were put to rest, at least temporarily, when Nvidia disclosed its third quarter numbers in mid-November and, once again, beat analysts’ forecasts while it also provided bullish guidelines for next year. Based on Nvidia’s order book, data centre related revenues are expected to increase by another 70%. Markets rebounded as a result.

Volatility hit Asian markets as much as it hit US and European markets, with the notable exception of Southeast Asia and India that have little direct exposure to AI investment themes.

In the AI space, the discussion within the investment community switched in November from the bottleneck that exists in accessing rare earth magnets to the bottleneck that has developed in accessing energy sources. This is a topic we touched on last month when we wrote that the US built 30GW of new electricity generation capacity in 2024 (a number quite similar to what the European Union and India each developed the same year), when China built 426GW.

In November Jensen Huang, the CEO of Nvidia shocked his audience when he declared bluntly that “China is going to win the AI race” before explaining that the electricity subsidies offered by the Chinese government was making Chinese data centres much more competitive to operate than any other data centres in the world. However, the condition for Chinese data centres to claim subsidies is to operate exclusively on Chinese GPUs (such as Huawei Ascend chips, which admittedly use 30% to 50% more electricity to generate the same amount of “tokens” as Nvidia’s equivalent chips).

Also in November, it was Satya Nadella, the CEO of Microsoft who commented that he did not have access to enough power to operate all the GPU chips his company had bought from Nvidia. And finally, Sam Altman, the CEO of OpenAI said “the biggest issue we are now having is not a compute glut, but it’s power”.

The issue with power is not only about production and transmission. It is also about storage, especially when power is generated from renewable energy sources that are building up fast around the world. Batteries and Energy Storage Systems (ESS) specially dedicated to AI data centres are sectors to follow closely. The main players in ESS are, in decreasing market share order, Tesla in the US, Sungrow Power Supply in China, Fluence Energy in the US, LG Energy Solution and Samsung SDI in Korea.

This is not to say that the issue about rare earth is over. Quite the opposite. The agreement reached between Xi and Trump at the end of October when they met in Busan was about China suspending for one year the Chinese equivalent of the US Foreign Direct Product Rule (FDPR) it started to impose on the rest of the world in April 2025 for exports of rare earth magnets. The FDPR is a rule imposed by the US on technology companies around the world since October 2020 that says that no company anywhere on the planet can sell any chip, equipment or software to China that is using any form of US technology.

Even though an agreement was reached on the temporary suspension of the Chinese version of FDPR applied to rare earth, Chinese exporters of rare earth still need to obtain an export license from the Chinese Ministry of Commerce. And it is our understanding that only three licenses were given out since Trump and Xi met in October, and only for exports to specific clients. Sales to any company related to the US military are banned.

November also saw Japan and China entering a new political crisis following provocative comments made by the new Japanese prime minister about the Taiwanese situation. To our surprise market impact was limited, except for travel platforms such as Trip.com given that China cut by half the number of flights between the two countries and asked its citizens to refrain from visiting Japan. Chinese tourists represented 20% of all tourists who visited Japan in 2024.

Macro numbers coming from India surprised us in November. GDP growth in the third quarter of the calendar year was 8.2% YoY, the highest print of the last six quarters, up from 7.8% YoY in Q2, and well above Bloomberg’s consensus estimate of 7.3%. Another surprising number was inflation, with the Indian CPI index rising by only 0.25% YoY in October, the lowest print since data started being published using a new methodology in 2013. Food inflation was a negative 5% YoY. Admittedly there was a high base effect from October 2024 that impacted these inflation numbers, but they were still well below Bloomberg estimates.

On the commodity front where we have exposure, we saw gold price moving up by 5.9% in November after seeing a 10% drop from peak to trough in October. We are exposed to gold through gold mining companies located in China. In our opinion, gold remains on a long-term uptrend path due to the constant purchases by emerging markets central banks of physical gold to reduce their exposure to the US dollar, while ever-increasing fiscal deficits and government debt in the western part of the world remains a risk to fiat currencies’ stability. The correction we saw in October was a natural mean reversion to the sudden spike in gold price that started in September, largely driven by retail investors’ sudden interest in precious metal.

WORDS FROM THE MANAGER

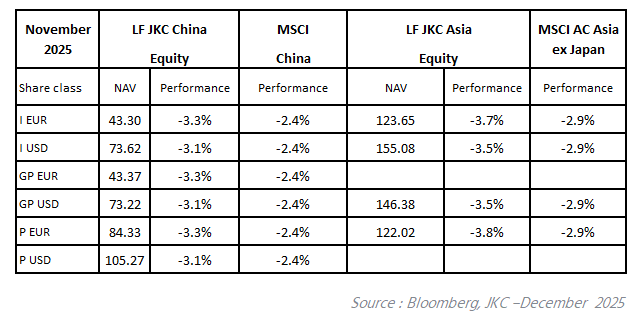

Monthly Performance

The doubts that emerged in November about the magnitude of hyperscalers’ capital expenditures to buy more AI chips and build more data centres has given rise to a debate as to whether AI related companies were in a market bubble or not. This debate led to a correction in Taiwanese and Korean technology stocks, with TSMC losing 4%, Samsung Electronics losing 5.8% and SK Hynix losing 4.1% over the month. Chinese chipmakers also suffered, with the two largest foundries SMIC and Hua Hong losing 8.3% and 6.6% respectively. The main TAIEX index of Taiwan lost 2.2% while the KOSPI index of Korea lost 4.4%. The MSCI China index lost 2.4%, and the CSI300 index of Chinese A shares lost 2.5%.

In this down month during which the tech sector was an underperformer, the Chinese financial sector was a clear outperformer, for the second month in a row. China Life Insurance gained 9.5%, China Merchant Bank was up 7.5%, ICBC was up 7% and Bank of China was up 6.4%. India in general also performed well with the Sensex index gaining 2.1%, with a special mention within our portfolio of second-hand truck financier Shriram Finance that gained 13.7% and auto manufacturer Mahindra and Mahindra that gained 7.8%.

CHINA PORTFOLIO

La Francaise JKC China Equity saw its NAV per share drop by 3.1% in November when the MSCI China index dropped by 2.4%.

The cash position of the fund stood at 4.7% at the end of the month.

The best performers in the fund this month were China Life (+9.5%), Akeso (+8.4%), China Resources Land (+7.5%), China Merchant Bank (+7.5%) and ICBC (+7.0%).

The worst performers were Tencent Music (-17.9%), Zhejiang Sanhua (-14.9%), PDD (-13.9%), JD.com (-8.7%) and SMIC (-8.3%)

During the month we exited Damai Entertainment while we added to the portfolio Sungrow Power Supply. Sungrow is a USD52bn A share company listed in Shenzhen that is a global market leader in photovoltaic inverters and energy storage systems (ESS). It is aggressively moving into ESS for AI data centres and is seeing this division that represents today half of the total turnover more than double year after year, with no sign of any slowdown. The company is trading at 21x its 2026 expected earnings for an earnings growth of 18%.

ASIA PORTFOLIO

La Francaise JKC Asia Equity saw its NAV per share drop by 3.5% in November when the MSCI Asia ex-Japan index dropped by 2.9%.

The cash position of the fund stood at 3.7% at the end of the month.

The best performers of the fund this month were Shriram Finance (+13.7%), Mahindra and Mahindra (+7.8%), China Merchant Bank (+7.5%), ICBC (+7.0%) and AIA Group (+6.8%).

The worst performers were Tencent Music (-17.9%), SMIC (-8.3%), Alibaba (-8.2%), Wuxi Apptec (-6.8%) and Samsung Electronics (-5.8%).

In November we exited Eternal Ltd. in India and Mediatek in Taiwan. We also added Krsnaa Diagnostic in India and Sungrow Power Supply in China.

Krsnaa Diagnostic is a leading player in the Indian diagnostic sector that operates on a public private partnership model whereby it runs the pathology and radiology centres of public hospitals across 18 states and territories of India. It recently obtained the contract to run all such centres in public hospitals across Rajasthan, which will see its business expand by approximately 50% in the coming months. The company is trading at 16x next year’s earnings with earnings growth expected at 51%.

ESG HIGHLIGHTS OF THE MONTH

The backlash against ESG initiatives in the United States has escalated to a new level, with a coalition of 16 state Attorneys General (AGs) sending formal letters to leaders of tech giants—including Microsoft, Google, and Meta. The missive urges the companies to reject compliance with the European Union’s landmark sustainability regulations: the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). The AGs warn that the rules’ “ambiguous and often unascertainable reporting requirements” expose firms to significant US legal risks, ranging from deceptive trade practice lawsuits to antitrust scrutiny.

This US pushback aligns with a broader trend of EU retrenchment on ESG mandates. In November, European Parliament lawmakers approved sweeping cuts to the bloc’s sustainability reporting and due diligence framework, including drastic reductions in the number of companies subject to the CSRD and CSDDD, as well as the elimination of mandatory climate transition plans. The revised rules raise the CSRD threshold to 1,750 employees and €450 million in annual revenues—dramatically narrowing its scope—while restricting the CSDDD to only the largest enterprises: those with 5,000+ employees and over €1.5 billion in revenues.

Building on this shift, the European Commission has proposed far-reaching amendments to the Sustainable Finance Disclosure Regulation (SFDR), aiming to overhaul a framework policymakers describe as “cumbersome for firms and confusing for investors.” A cornerstone of the reform is a fundamental recalibration of disclosure requirements: the Commission plans to scrap entity-level reporting on “principal adverse impacts” for most financial market participants, while streamlining product-level disclosures to include only information deemed “available, comparable, and meaningful.”

Against this backdrop of regulatory rollbacks, the international community turned its attention to COP30—the UN climate conference held in Brazil in late November—with low expectations that were ultimately fulfilled. For the second consecutive year, the summit’s final agreement avoided any explicit reference to phasing out fossil fuels, despite fierce objections from the EU and the UK. The deal also failed to include a binding roadmap to end deforestation, a key priority for climate advocates. Notably, more than 80 countries had pushed for the agreement to incorporate clear language on transitioning away from coal, oil, and gas, but their efforts were defeated by adamant opposition from fossil fuel-dependent nations including Saudi Arabia, Russia, and India—ensuring fossil fuels remained unmentioned in the final text.

The information contained herein is issued by JK Capital Management Limited. To the best of its knowledge and belief, JK Capital Management Limited considers the information contained herein is accurate as at the date of publication. However, no warranty is given on the accuracy, adequacy or completeness of the information. Neither JK Capital Management Limited, nor its affiliates, directors and employees assumes any liabilities (including any third party liability) in respect of any errors or omissions on this report. Under no circumstances should this information or any part of it be copied, reproduced or redistributed.