October 2025

JKC Asia Bond 2025 – Fixed Maturity Fund October 2025 Update

- The Fed dominated global bond markets in September as the US central bank cut interest rates by 25bps in a highly anticipated meeting

- US economic data, however, remained extremely mixed with jobs data once again coming in below expectations while CPI continued to rise

- Another major downward revision of Non-Farm Payrolls fueled a rally in US Treasury bonds and subsequent gains in global risk assets…

- … however a surprise 2Q GDP upgrade and a subsequent jump in both the USD and US Treasury yields limited these gains at month end

- Despite the market volatility, Asian High Yield and Investment Grade dollar bonds had another strong month of positive performance

- New World Development led the High Yield advance on the back of Hong Kong property market optimism although China property giant Vanke saw contrasting performance after announcing plans for onshore loan renegotiations

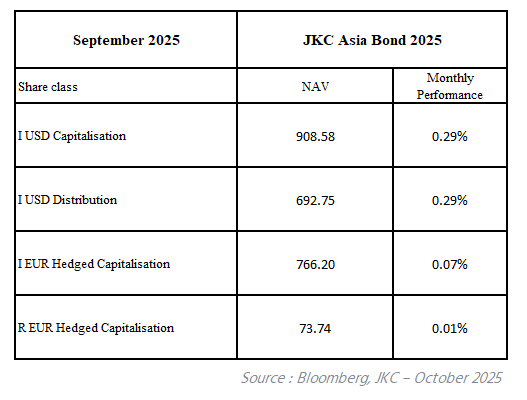

- JKC Asia Bond 2025 saw a 0.29% gain in the month once again reflecting the average yield of the short-dated positions in the fund.

Mixed economic data out of the US, combined with contrasting messaging from the Federal Reserve, created volatility for global markets which surged in early September but saw performance tempered towards month end. Asian credit markets followed a similar pattern although both Investment Grade (IG) and High Yield (HY) Asian dollar bonds ultimately saw gains driven mostly by bond accruals. The JKC Asia Bond 2025 portfolio saw very little volatility and maintained the stable appreciation trend seen in recent months with a gain of 0.29% for the month.

September was always going to be a month highly focused on the US Fed as the mid-month meeting of the FOMC had long been anticipated as the start of a new interest rate tightening cycle. Indeed, while the opposing forces of employment and inflation data had kept the debate alive, the market consensus of economists and the Federal Reserve members themselves appeared to be in agreement that the first interest rate cut of the year was justified. However, the magnitude of the cut was still in doubt, particularly after payroll data released on September 5th showed both much lower than expected job additions for August (22,000 only) and another major downward revision from the previous month’s release. This revision in fact saw the June Non-Farm Payroll (NFP) number fall to -13,000, the first negative reading since Covid. Signs of a much weaker US job market than previously assumed also increased after the full year NFP adjustment for the period covering April 2024 to March 2025 came in at -911,000, also worse than expected. Rising expectations of a potential surprise 50bps interest rate cut at the September meeting saw US Treasury yields drop sharply in early September, fueling a rally across global risk assets.

The bond rally was, however, curtailed by CPI inflation data that, although coming in line with expectations with a core number at 2.9%, was still well above the Fed’s target of 2%. It was the fourth consecutive month of rising inflation in the US, and it quickly poured cold water on the 50bps rate cut hopes. Ultimately the Fed announced a 25bps rate cut on September 19th and despite vocal dissent from new Trump appointed FOMC member Stephen Miran, the Fed dots chart continued to point to a gradual easing path for the rest of 2025 and 2026.

Adding further confusion to the economic picture, US 2Q GDP was revised sharply up from 3.3% to 3.8%, the highest QoQ gain since 2023 and a stark contrast to the weak jobs picture. The combination of a tepid rate cut with a positive GDP surprise saw US Treasury yields rebound towards month end, reining in gains in the bond market. A rebound in the USD on the back of the GDP number further weighed on Asian credit markets as Asian CDS spreads spiked at month end. Nevertheless, the Asian IG heavy ADBI index ended September with a gain of 0.95% while the HY equivalent AHBI gained 1.26% over the same period.

Leading the Asian HY market was once again distressed HK property giant New World Development as optimism for a recovery grew on the back of US interest rate cuts, news of another successful new loan signing as well as reports of improving property sales in Hong Kong. While the company’s FY25 results (with a June year-end) continued to point to a challenging operating environment, the NWDEVL bond curve saw another 5 to 10 points gain in September, adding to the rebound that began in August.

In contrast Chinese property developer Vanke saw its offshore bonds fall by 5 to 10 points following reports that it was seeking an interest payment renegotiation with some of its onshore private creditors, pointing to the continued extremely tight cash flow position of the developer despite the recent takeover by SOE shareholders. However, with very little representation of Chinese developers in the overall index, the Vanke fall had limited impact on the overall Asian HY market.

Monthly Performance

The information contained herein is issued by JK Capital Management Limited. To the best of its knowledge and belief, JK Capital Management Limited considers the information contained herein is accurate as at the date of publication. However, no warranty is given on the accuracy, adequacy or completeness of the information. Neither JK Capital Management Limited, nor its affiliates, directors and employees assumes any liabilities (including any third party liability) in respect of any errors or omissions on this report. Under no circumstances should this information or any part of it be copied, reproduced or redistributed.