December 2025

JKC Asia Bond 2025 – Fixed Maturity Fund December 2025 Update

- Global equities dropped in early November driven by AI growth fears although a sharp month end rebound capped losses

- US interest rate outlook remained murky given a lack of key economic data releases in November and increasingly split opinions within the FOMC

- Trump announced he will soon unveil replacement for Jerome Powell although prospects of more dovish Fed leadership did little to push long term yields lower

- Credit spreads held up well despite a ramp up in volatility and Asian Investment Grade bonds ended the month broadly unchanged…

- …although the High Yield market once again was hit negatively by write downs in the China property sector with Vanke bonds collapsing after reports of a debt extension plan

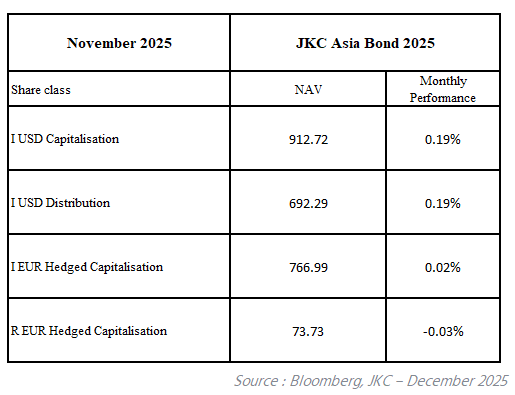

- JKC Asia Bond 2025 portfolio closed the month up +0.19% reflecting the average yield of the remaining positions in the fund.

December saw global markets experience their first meaningful correction since April as a combination of doubts over both US interest rate policy and growth projections of AI related sectors called into question the lofty valuations seen in equities. The market’s jitters were exacerbated by a sharp decline in crypto currencies which instead of providing an equity hedge have instead proven to be high beta plays on overall risk appetite. Most equity markets had recovered most losses by month end but the jump in volatility still weighed on Asia’s dollar bond markets. The investment grade (IG) heavy ADBI Index closed out November up just +0.23%, its weakest monthly gain since May while the high yield (HY) AHBI fell -0.86% over the same period.

US Treasury markets were generally rangebound for November as a marginal decline in yields at the short end of the curve was offset by some curve steepening at the long end. Expectations of an interest rate cut at the next (11th December) Federal Reserve meeting flip-flopped throughout the month as it appears the FOMC has split into dovish and hawkish camps following the data vacuum produced by the prolonged US government shutdown. While the resumption of data releases (particularly the BLS inflation and jobs reports) should bring some welcome clarity, uncertainty on future Fed policy will probably continue into 2026 as President Trump is expected to soon announce a new likely dovish leaning Federal Reserve Chairman, to replace Jerome Powell next year. This raises the prospect of increased steepening of the yield curve if aggressive future cuts are not supported by falling inflation data. Credit markets in contrast remained surprisingly benign as the jump in equity market volatility (VIX Index spiking at >25 intra-month) did not push emerging markets spreads significantly wider and helped Asian IG markets end the month little changed.

Asian HY market’s underperformance meanwhile was almost exclusively driven by one name, China Vanke, which saw its bonds crash by 40-50pts in November hitting their lowest ever level of 20 cents at month end. The drop followed news that Vanke was seeking a delay in payment of its onshore bonds, due in mid-December, on account of constrained cash flow. Vanke, once China’s largest investment grade developer, had been on an apparent recovery path after its state-owned shareholder Shenzhen Metro had pledged financial support for the company in early 2025. However, as the scale of Vanke’s liabilities became apparent the SOE had recently signaled limits to their support and the rare request of restructuring for onshore liabilities became the straw to break the camel’s back. Understandably this sent renewed jitters through all property names and although the sector has become a small weighting in indices after most issuers already defaulted, the Vanke collapse shows it still has some capacity to impact the wider market.

With no high yield positions remaining in the portfolio, the JKC Asia Bond 2025 portfolio saw little impact itself from the Vanke drop ending the month up +0.19% as returns continue to be primarily driven by accruals of remaining positions in the fund.

Monthly Performance

The information contained herein is issued by JK Capital Management Limited. To the best of its knowledge and belief, JK Capital Management Limited considers the information contained herein is accurate as at the date of publication. However, no warranty is given on the accuracy, adequacy or completeness of the information. Neither JK Capital Management Limited, nor its affiliates, directors and employees assumes any liabilities (including any third party liability) in respect of any errors or omissions on this report. Under no circumstances should this information or any part of it be copied, reproduced or redistributed.