October 2025

THE CIO’S PERSPECTIVE

Seeing Xi, Modi and Putin side by side alongside leaders from 21 other Asian countries at the Shanghai Cooperation Organisation summit held in the Chinese city of Tianjin at the start of the month was a strong signal given to the United States that an anti-Trump coalition was building up in this part of the world, led by China. It was even more symbolic to watch the leaders of China and India confer together given that the two countries have had tense relationships for decades. The fact that Trump imposed a 50% tariff on Indian exports to the US (with the notable exception of pharmaceutical products that are critical to the US healthcare system) was widely perceived in India as a revenge for not letting Trump take credit and help him get a Nobel Peace prize for ending the 4-day war that flared up between India and Pakistan in May.

A second wave of hostilities against India did not help, and this time it was about imposing a USD100,000 fee on all H1B visa applications, which is the only way Indian IT consultants from India can work on-site for their Wall Street clients. Out of the 283,000 H1B visas awarded by the US to foreign citizens in 2024, 71% were from India. The IT industry of India represents approximately 8% of the Indian GDP. The standoff between India and the US is even more serious that Trump wants to force India to cancel all import duties on US agricultural products, soybeans in particular. This is an absolute no-go for Modi as agriculture employs 40% of the Indian workforce, or 250 million people who tend to be among the poorest in the country.

At the same time China and India need each other more than ever: China badly needs new consumer markets to get its industrial sector back on its feet, while India badly needs Chinese technology to upgrade its own production tools and accelerate its development. Future history books might well describe one day Trump’s sudden hostile stance against India as a major geopolitical mistake.

In China, exports of rare earths magnets have resumed with 6146 tons of permanent magnets shipped in August, up 10.2% over July, but exports to the US were only 590 tons, down 5% over July. Europe, Japan and India were the prime beneficiaries of these exports. Foreign companies which import these rare earth magnets now need to obtain licences from the Chinese government and disclose what these magnets will be used for. Even though the Chinese government no longer publishes detailed statistics, the word is around that exports of antimony and germanium that are used for making military equipment have come to a halt. Out of the 141 export licence applications filed by members of the European Union Chamber of Commerce in China to purchase Chinese permanent magnets, only 21 were granted so far. Rare earth magnets remain by far the strongest bargaining chip of the Chinese government when facing sanctions from the rest of the world. As a reminder, China controls 90% of the global refined rare earth market, which is typically used in sectors ranging from microprocessors to all kinds of vehicles, and from household appliances to guided missiles.

The boost in sentiment across Chinese markets over the past two months was largely triggered by Xi’s successful pushback against Trump’s tariff policies. This positive sentiment was further boosted in September by Alibaba’s release of its latest AI technology and “Qwen” Large Language Model, and its plan to invest “significantly more” than the RMB 380bn it had already earmarked for the years 2025-2027. The focus will be on AI, on cloud infrastructure and on overseas expansion, with Alibaba data centres to open soon in the Netherlands, Brazil and France.

On the hardware front, readers may remember that in August, Jensen Huang, the CEO of Nvidia convinced Trump to let Nvidia sell H20 AI GPUs to China, an announcement which was shortly followed by China requesting that Chinese IT companies stop buying chips from Nvidia for national security reasons. The fact that China shut the door to Nvidia was because Huawei’s Ascend 910B chips produced locally by SMIC is apparently powerful enough to replace Nvidia’s H20. In September the news came out that a Chinese company named Yuliangsheng managed to develop the first Chinese-made Deep Ultraviolet (DUV) lithography machine capable of producing 5 nanometre advanced chips, and that it was being tested at the SMIC fab in Shanghai. If this is indeed true, it would be a critical breakthrough in China’s quest for full technological autonomy. Until now, the only company in the world capable of manufacturing DUV and EUV (Extreme Ultraviolet) lithography machines is ASML, in the Netherlands. And of course, the United States has prevented ASML from selling DUV and EUV equipment to any fab that would use them to the benefit of Chinese customers. These two events explain the very bullish sentiment that currently prevails around Chinese AI and Chinese chip manufacturing.

The Korean and Taiwanese markets followed the same pattern, both recording strong performances in September. In Korea, it is worth highlighting a significant improvement in corporate governance because of reforms implemented by the new left-wing president Lee Jae-myung who campaigned on the promise that he will bring the Kospi index to 5000 (it is now around 3450). Companies are now much incentivised to pay larger dividends (Korea always had the lowest payout ratio of Asia) through tax breaks. Once passed by the Korean parliament, the higher the dividend payout ratio, the lower the tax rate will be for listed companies and their shareholders. Listed Korean companies now also have a strong incentive to cancel treasury shares following market buy-backs, something that we hope Chinese regulators will get inspiration from one day.

Elsewhere in Southeast Asia, the mood is gloomy. Indonesia saw riots taking place across the country as Prabowo, the new president, is increasingly flirting with authoritarianism and abuse of power, while the Philippines saw people take the street to protest a high-profile corruption case involving the government and a member of parliament. Finally, once again, Thailand saw its government collapse following the successful impeachment of its prime minister. The political landscape of Thailand remains as murky as it has always been. It is sad to report that these three countries have been major disappointments from an investment perspective. We are glad not to be exposed to any of them.

WORDS FROM THE MANAGER

Monthly Performance

The IT sector has been on fire lately, with mega caps leading the trend. In Korea, Samsung is back to life, especially after Nvidia formally endorsed the Samsung High Bandwidth Memory chips (HBM3), allowing Samsung to break into the Nvidia memory supply chain that was essentially dominated until now by SK Hynix. Samsung Electronics gained as much as 20.4% in September while SK Hynix gained 29.2%.

In Taiwan, TSMC is once again the main beneficiary of the rising capex plans of global AI companies since most chips, be it developed by Nvidia, Alphabet, Oracle or Apple will end up being manufactured by TSMC. Its share price gained 12.5% in September.

In the battery space, the National Development and Reform Commission of China which oversees state planning announced that the country will double its energy storage capacity to 180GW by the end of 2027 with $35bn of investments. This decision pushed up the share price of Shenzhen-listed CATL to which we are exposed by 31.3%. CATL, based in Fujian, China, is the world’s largest battery manufacturer.

On the pharmaceutical front there has been quite a bit of confusion around Trump’s decision to apply a 100% tariff on all branded drugs made by overseas companies that do not have operations in the US. Unbranded generic drugs, active pharmaceutical ingredients and drugs being developed overseas by contract and development manufacturers such as those in China and India do not seem to be impacted, but we all know that Trump regulations can change overnight. Wuxi Apptec, the main Contract Development and Manufacturing Organisation (CDMO) for chemical drugs in China to which we are exposed gained 8.1% in September while pharmaceutical companies Akeso which is in advanced talks with AstraZeneca to licence one of its proprietary drugs lost 9.3%. Its larger peer Hengrui Pharmaceutical which also has a pipeline of innovative drugs ready to be licensed out and to which we are also exposed gained 16.5% in September.

Another major market driver in September was gold price, to which we are directly exposed through our investments in Zijin Mining, a copper and gold mining company and Zhaojin Mining, which is exclusively exposed to gold mining. Both companies have done very well lately, up 27.4% and 29.7% respectively in September as gold price reached $3800 per ounce. Zijin Mining also made headlines in the past week as it spun off its overseas gold mines on the Hong Kong stock exchange through the second largest IPO in the world this year (the largest was CATL, also in Hong Kong). The share price of Zijin Gold International gained 68.5% on its first day of trading. Being a shareholder in Zijin Mining, we were allocated shares in Zijin Gold International.

CHINA PORTFOLIO

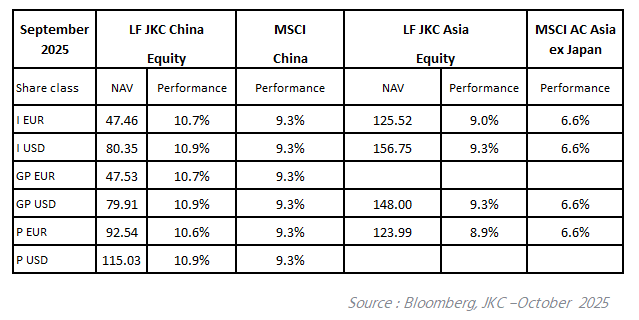

La Francaise JKC China Equity saw its NAV per share rise by 10.9% in September when the MSCI China index rose by 9.3%.

The cash position of the fund stood at 4.2% at the end of the month.

The best performers in the fund this month were Alibaba (+53.0%), Baidu (+49.0%), Zhejiang Sanhua Intelligent Controls (+40.6%), CATL (+31.3%) and Zhaojin Mining (+29.7%). The worst performers were Meitu (-21.2%), Suzhou TFC Optical (-15.5%), Akeso (-9.3%), China Life (-8.0%) and Damai Entertainment (-7.8%).

During the month we introduced to the portfolio SMIC, the largest semiconductor manufacturer of China while we increased our exposure to JD Health, JD.com, Meituan and Wuxi Apptec. We reduced our exposure to BYD, Bank of China and China Merchant Bank while we exited China Resources Land and Pop Mart.

ASIA PORTFOLIO

La Francaise JKC Asia Equity saw its NAV per share rise by 9.3% in September when the MSCI Asia ex-Japan index rose by 6.6%.

The cash position of the fund stood at 2.0 % at the end of the month.

The best performers of the fund this month were Alibaba (+53.0%), CATL (+31.3%), Zhaojin Mining (+29.7%), SK Hynix (+29.2%) and Samsung Electronics (+20.4%). The worst performers were Meitu (-21.2%), Rainbow Children’s Medicare (-9.7%), Akeso (-9.3%), Mediatek (-4.0%) and ICICI (-3.6%).

During the month we introduced to the portfolio Polycab, the largest electric cable manufacturer of India and Suzhou TFC, the Chinese optical communication module manufacturer that is part of the Nvidia supply chain. We also increased our exposure to Alibaba, Wuxi Apptec, Samsung Electronics and Rainbow Children’s Medicare. We reduced our exposure to Hong Kong Exchange while we exited BYD, China Resources Land and China Construction Bank.

OUR ESG ENDEAVOURS THIS MONTH

In early September, the Hong Kong Monetary Authority (HKMA) unveiled a draft updated version of the Hong Kong Taxonomy for Sustainable Finance. This taxonomy serves as a classification framework designed to define and categorize environmentally sustainable economic activities, with the ultimate goal of channeling capital toward these areas. A key proposal in the draft is to expand the taxonomy’s coverage to include transition activities, along with new sectors and specific activities. Under the newly proposed “Phase 2A” initiative, the taxonomy’s scope will be extended to two additional sectors: manufacturing, and information & communications technology. Furthermore, 13 new activity categories will be added, such as electricity transmission and distribution, district heating and cooling systems, and low-carbon transportation infrastructure.

In mid-September, Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), issued a warning indicating that the SEC might revisit its existing rules. These rules currently permit foreign companies to submit their financial statements using the International Financial Reporting Standards (IFRS). The potential reassessment stems from the IFRS Foundation’s establishment and its support for the International Sustainability Standards Board (ISSB). Atkins’ remarks mark the latest step in a series of actions taken by the SEC since the start of the Trump administration, all of which aim to push back against the growing global demands for enhanced corporate sustainability and climate-related reporting requirements.

Two major standards-setting bodies, the International Organization for Standardization (ISO) and the Greenhouse Gas Protocol (GHG Protocol), announced the launch of a groundbreaking new strategic partnership. The core objective of this collaboration is to unify the global standards employed in measuring and reporting greenhouse gas (GHG) emissions. According to ISO and the GHG Protocol, the partnership was formed to tackle a critical barrier to climate action: the fragmentation of existing standards and policies. By creating a harmonized global “language” for emissions accounting, the initiative will simplify compliance processes for companies, boost consistency for policymakers, and ultimately reduce the overall burden associated with measuring and reporting GHG emissions.

In late September, China announced a new round of Nationally Determined Contribution (NDC) targets at the UN Climate Change Summit. Most noticeably, the country sets its first ever absolute target to reduce GHG emissions by 7% to 10% from the peak by 2035. President Xi outlined other pledges for the country, including a plan to increase its share of non-fossil fuels in total energy consumption to more than 30% and expand installed capacity of wind and solar power more than six times 2020 levels, making China one of the very few countries that are still accelerating their efforts against climate change.

The information and material provided herein do not in any case represent advice, offer, sollicitation or recommendation to invest in specific investments. The information contained herein is issued by JK Capital Management Limited. To the best of its knowledge and belief, JK Capital Management Limited considers the information contained herein is accurate as at the date of publication. However, no warranty is given on the accuracy, adequacy or completeness of the information. Neither JK Capital Management Limited, nor its affiliates, directors and employees assumes any liabilities (including any third party liability) in respect of any errors or omissions on this report. Under no circumstances should this information or any part of it be copied, reproduced or redistributed.